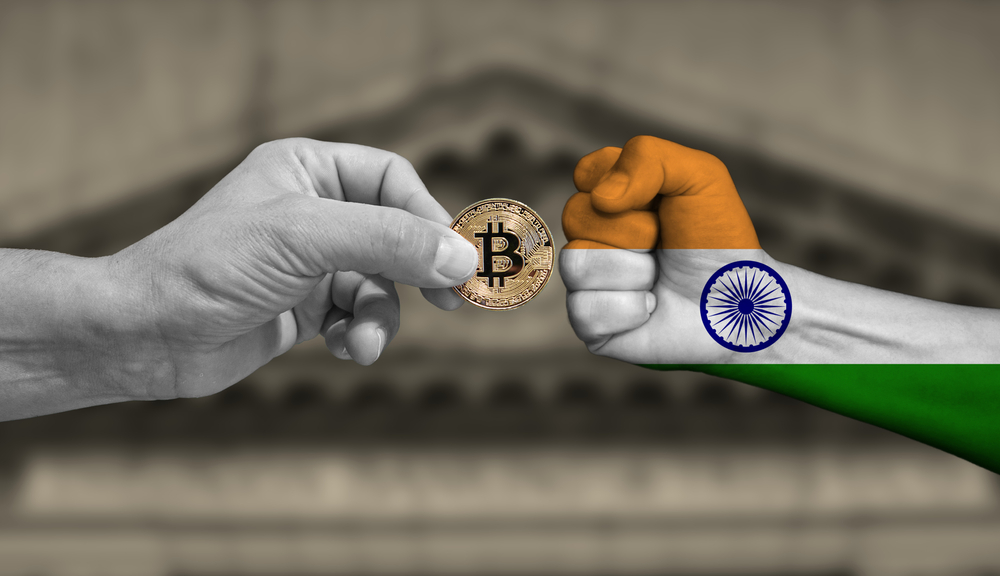

- India’s Finance Secretary said that crypto, including BTC, will never be legal tender in India.

- The Finance Secretary also emphasized that crypto lacks the government’s support.

- Recently, India proposed 30% taxation on Non-fungible tokens and cryptocurrencies.

T.V Somanthan, India’s Finance Secretary, declared that the country would never legalize cryptocurrencies, including BTC and ETH, as an official currency. The nation will only accept the RBI’s digital rupee as a legal tender.

India Will Not Adopt Bitcoin as El Salvador

India’s Finance Secretary revealed that crypto-assets such as non-fungible tokens, Bitcoin, and Ethereum would never be legal tender in India. Remember, the nation has been skeptical about the crypto market for a long, postponing the much-awaited crypto bill.

Recently, India unveiled plans to launch a central bank digital currency (digital rupee). The Reserve Bank of India will issue and back the digital coin. The Finance Secretary emphasized that the country will only recognize the digital rupee as a legal tender.

Meanwhile, the central bank has tested the digital rupee for many months to evaluate its effect on monetary and banking systems. Nirmala Sitharaman, the nation’s Finance Minister, believes introducing the CBDC will translate to an efficient and cheap fiscal management approach, boosting the country’s digital economy.

Somanthan added crypto’s worth depends on two individuals, and like gold or diamond, the government does not authorize values by these assets.

He stressed that any Indian citizen interested in cryptocurrency investment should beware that the government does not back crypto. He added that people interacting with this new asset class should prepare for potential losses that the authorities will never bother.

Though India has remained indecisive on whether to ban crypto for many years, it has never put such plans in motion. Nevertheless, cryptocurrency enthusiasts in India will incur a 30% tax on crypto income. The taxation sparked debate across the crypto community as most investors thought it was unfair.

Nevertheless, India’s Finance Minister suggests a 1% tax deduction on transactions involving digital assets purchase.

What are your views on the Indian crypto market? Is the 30% crypto taxation better than the crypto ban? Feel free to comment below.

The information provided on this website should not be interpreted as financial or investment guidance and may not embody the perspectives of Forex Tools Trader or its contributors. Forex Tools Trader does not hold responsibility for any financial setbacks experienced due to the use of information provided on this website by its writers or patrons. It's essential to thoroughly investigate and make informed decisions before entering any financial commitments, particularly concerning third-party reviews, presales, and similar ventures. The content you are viewing may be sponsored content, read our full disclaimer to learn more.